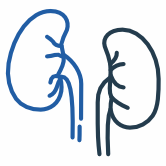

Book Doctor Appointment

Punarjan Ayurveda Best Cancer Hospital in Hyderabad, India empowers patients with immune-modulation and natural detoxification to take an active role in their healing journey. Embraces Ayurveda to promote overall wellness through Ayurvedic Cancer Treatment in India.

At Punarjan Ayurveda, we provide the best possible and personalized approach by providing treatment with Rasayana Ayurveda for all types of cancers without causing any side effects. We have successfully provided not only the treatment to some of the most complex cases but also enhanced the quality of their life during the treatment.

Expert Doctor

Specialized doctors helps to balance your 3 Doshas – Vata, Pitta & Kapha.

Latest Technology

Since 25yrs we have strong Research & Development Team.

Highest Success Rate

Higher chances of getting recovered by immunotherapy even in last stage of cancer.

Free Counseling

Get Free counseling with our Best Expertise Ayurvedic Doctors

Dr. Bommu Venkateshwara Reddy; the visionary founder of Punarjan Ayurveda, is a true embodiment of passion and dedication. With a deep-rooted belief in the holistic healing powers of Rasayana Ayurveda, Dr. Venkateshwara Reddy embarked on his remarkable journey for more than 2 decades in his search for traditional wisdom and modern expertise.

Punarjan Ayurveda Hospitals the best Ayurvedic Cancer Hospital in India, where patients receive personalized attention, customized treatment plans, and compassionate care. This visionary leadership and innovative approach has expertise in treating cancer and has transformed thousands of lives, offering a holistic path to wellness and healing.

CEO & Founder

Dr. Bommu Venkateshwara Reddy

Recognizing the challenges that come with seeking medical treatment in a foreign country, Punarjan Ayurveda is not only the Best Cancer Hospital in USA but also offers comprehensive services to support international patients and ease the stress of traveling abroad. Our dedicated team is committed to taking care of you and your loved ones, ensuring that you always feel at home during your stay with us.

We aim to alleviate any practical concerns so that you can focus solely on your health and well-being. Our worldwide patient services team is with you every step of the way, providing the necessary support throughout your journey.

Success Stories

![]()

Facts About Rasayana Ayurveda Cancer Treatment

![]()

Rasayana Ayurveda is a centuries-old medical tradition from India that emphasizes body rejuvenation. Although the classical Ayurvedic texts like the “Charaka Samhita” and the “Sushruta Samhita” do not explicitly mention cancer in the sense that we currently understand it, they do talk about some pathological conditions that are related to abnormal growths, tumors, and inflammatory conditions that could be interpreted in the context of cancer.

Ayurvedic medicines, including Rasayana, frequently center around all encompassing methodologies, customized natural definitions, and lifestyle changes. While the certain formulations may have costs, the general methodology can now and again be more financially justified.

Although there is increasing interest in combining Rasayana Ayurveda with modern cancer treatment, this integrative approach must be approached with caution. Before considering integrative therapies, professionals in the medical field should always be consulted, and individual patient-specific decisions are essential.

A special diet that focuses on balancing doshas, supporting overall health, and assisting in the rejuvenation of the body is considered an essential component of cancer treatment in Rasayana Ayurveda. The dietary rules are customized to the singular’s constitution (Prakriti). Let us talk about the significance of food in Ayurvedic cancer treatment now:

In one word — “No”! Unlike conventional cancer treatments, Rasayana Ayurvedic cancer treatment typically does not necessitate hospitalization. Since it is a comprehensive clinical framework, Ayurveda often integrates short term medicines and lifestyle changes that patients can carry out into their day to day routines. This ancient customized and diverse methodology focuses on reestablishing body harmony, reinforcing the immunity, and upgrading health over all.

It’s true that while modern medicine continues to fight cancer on multiple fronts, alternative approaches like Rasayana Ayurveda spark curiosity, especially when success stories emerge. However, it’s crucial to approach such claims with a scientific lens for better understanding. Here’s a breakdown of Rasayana Ayurveda success in the cancer treatment and its comparison to conventional cancer treatments.

Punarjan Ayurveda Treatment Structure

![]()

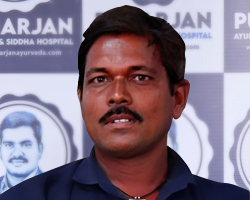

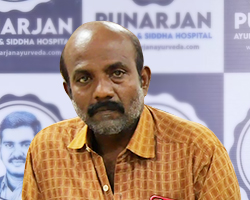

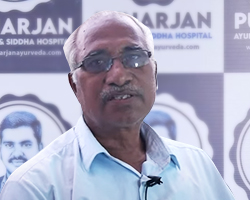

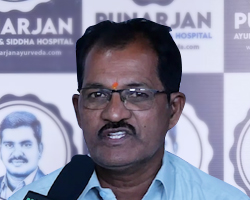

Survivors Stories

![]()

“To eliminate the fear of Cancer from people’s minds and make them realize that cancer is indeed a curable disease.”

What We Treat

![]()

Lung Cancer

Lung cancer is a type of cancer that begins in the lungs

Healing Touch With Punarjan Ayurveda

Importance Of Alkaline Water In Cancer Patients

Alkaline water has a higher pH level than regular drinking water. In recent days, it is evident that drinking alkaline water can neutralize acid in the body.

Diet Plan For Cancer Patients

A well-balanced diet full of important minerals and antioxidants is emphasized in cancer diet plans as it is crucial. There are many advantages of this diet for cancer patients. Ayurvedic Cancer Treatment recommends

Cancer Yoga Therapy

For cancer patients, yoga wellness programs offer a variety of advantages. Firstly, they aid in reducing stress, anxiety and depression. Yoga encourages relaxation and aids in mind-calming.

Breathe in Nature

Black Cohosh: Health Benefits

Now we are talking about a medicinal herb plant which is more available in North America called “Black Snake Root” as it looks like intertwined snakes on the lower […]

Bilberry: Health Benefits

Bilberry is similar to the Blueberry fruit species that looks in purple colour. It is grown at a low altitude. Its scientific name is Vaccinium myrtillus. They usually […]

Cocoa Tree: Health Benefits

We love chocolate for its great taste, but we do not have an idea as chocolate is also a medicine. Cocoa tree is also a key medicinal herb and […]

Cured Patients

We at Punarjan Ayurveda dedicate all services to eliminate the deadly fear of cancer.

Satisfied Patients

Dr. Bommu Venkateshwara Reddy has succeeded in revolutionizing and changing the whole spectrum of Ayurvedic treatment.

Punarjan Ayurveda Cancer Research Analysis

Latest News & Events

Innovations In Cancer Care: Advancements And Ayurvedic Impacting Cancer Patients In India

Advancement and innovation in cancer treatment have led to more and more people surviving cancer. There are new techniques and practices that promote health, ensure well-being, and prevent diseases. It […]

What are the Brain Tumor Warning Signs?

Abnormal cell growths in the brain, known as brain tumours, can manifest as either cancerous or noncancerous formations. Depending on their size, location, and growth rate, brain tumours can cause […]

Decoding Breast Cancer Risk: How Age Impacts Your Susceptibility

Age is a crucial determinant of health. It significantly influences susceptibility to various health conditions. It is especially evident in breast cancer age patterns. Research indicates a direct association between […]

Get in Touch

![]()

Punarjan Ayurveda Cancer Hospital is the best cancer hospital in Hyderabad, India offering a unique approach to cancer treatment. With our emphasis on Rasayana Ayurveda, we provide a holistic and natural alternative to chemotherapy and radiation. Our treatments are designed to eliminate cancer cells without causing any harmful side effects. At Punarjan, we believe in harnessing the healing power of Ayurveda to restore health and wellbeing. Choose our hospital for a comprehensive, effective, and safe cancer treatment that focuses on the body’s innate ability to heal itself.